What Is The Fire Movement?

Chances are you have heard the term “FIRE”, but what exactly does it mean? FIRE stands for the ‘Financial Independence Retire Early’ movement. Simply put, those in the FIRE movement believe that one does not have to work until traditional retirement age.

The “Old G” of the FIRE movement and someone many FIRE bloggers credit for introduction into the niche is Mr. Money Mustache. He explains that saving and investing a higher percentage of one’s income is the key to early retirement.

Who Is the fire movement for?

Okay, so I won’t pretend that A N Y O N E can FIRE with ease.

Someone making $7.75 will have a much harder (though not impossible) time of “Retiring Early”.

However, they can have a chance for financial independence in the form of financial stability.

I will say that the FIRE movement and the dream of retiring early is not just for high income earners. For instance, there are individuals from a wide range of income brackets buckling down and choosing to ‘FIRE’.

I am talking to the millennials often blamed for avocado shortages and gen-xer’s alike.

Many people within the movement are calculating their “FIRE” number and retiring early. Just search early retirees to be inspired by real life people of various income brackets reaching their FIRE goal.

The best part about the FIRE movement?

The blueprint is clearly mapped out for anyone up for the challenge.

“The simple principle behind the FIRE movement is to work and invest a higher percentage of your income now, so you can retire early.”

A “FIRE-Y” History: the 4% Rule

The Trinity Study was conducted in 1998 to test how various retirement portfolios performed over an extended period. Researchers analyzed every 30 year period from 1926 to 1995 based on different asset allocations and withdrawal rates to see the chances of one’s retirement portfolio lasting.

They discovered that a retirement portfolio of 50% long term high grade corporate bonds and 50% large cap stocks had a 100 percent success rate when coupled with a 4 percent withdrawal rate. This is the logic behind the 4% rule.

It suggests that if you withdrawal about 4% (inflation-adjusted) of your portfolio each year, your money will outlast you.

How much money should I save For fire?

The first thing you have to do if you want to pursue FIRE is to calculate your FIRE number.

How much money is enough money? I am glad you asked.

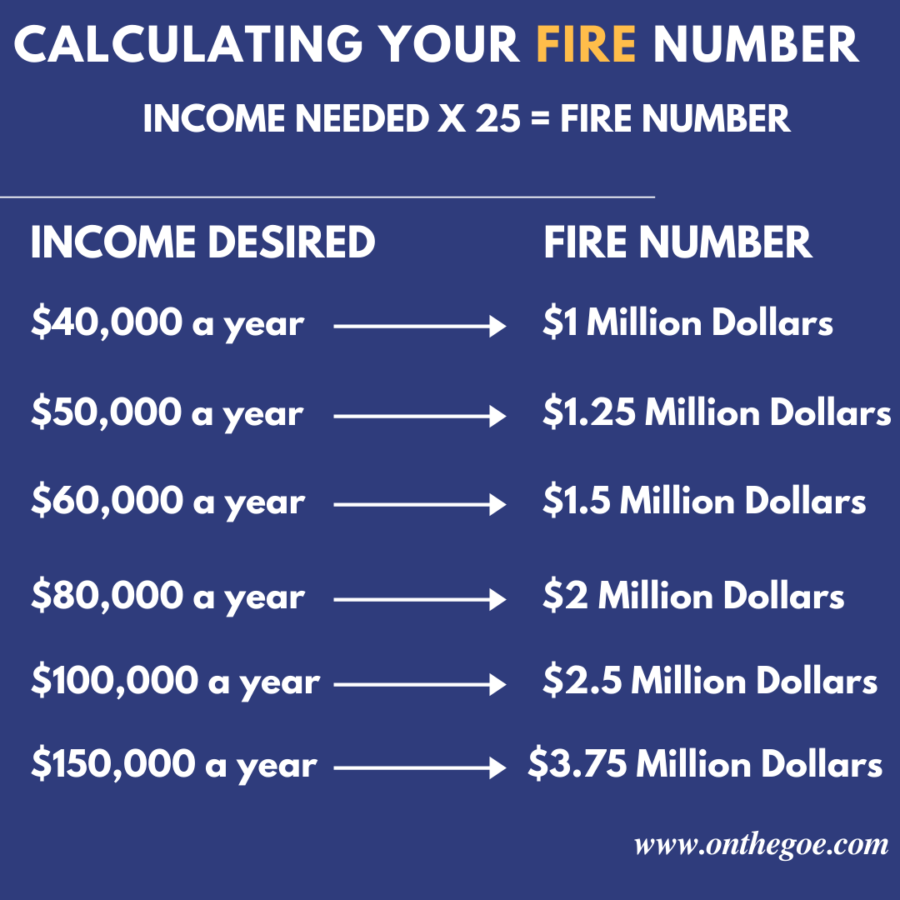

A common FIRE number often referenced is 1 million dollars. If you get your retirement nest egg to 1 million dollars, you can expect to withdraw about 4% each year (40,000 dollars) without affecting the principal. That means year after year, your retirement account will be able to sustain you.

If you think you can live on $40,000 grand a year, then your target FIRE number is 1 million dollars.

If you need $60,000 grand a year, then your target FIRE number is 1.5 million dollars.

Multiply the amount of income you believe you will need to live off by 25 and that is your FIRE number.

If you need some help figuring out this number, think about your current budget categories and also factor in what other frills and thrills that you like.

For instance are you someone who enjoys Taco Tuesday and filling your weekends with get-away trips?

Do you prefer a quieter life with more time with family and a closer circle? Think about what your true life desires are and then apply the FIRE formula.

Income Needed x 25 = FIRE Number

How To Reach Your “FIRE” Number And Rock The FIRE Movement

1) Get On A Budget

There are many proven ways to cut costs, starting with having and sticking to a budget! A budget allows you to tell your money where to go instead of wondering where it went. With a budget plan you can allocate money as you see fit, implement it and tweak it til you get to the right percentages best for your lifestyle.

This is arguably one of the most important factors for success in the FIRE movement.

2) Choose Smart, Diversified Investments

Although some advisers tout “beating the market”, the truth is the overwhelming majority of professional investors do not outperform the market over long periods of time.

Even investor extraordinaire and billionaire Warren Buffet agrees that low cost index funds are the way to go.

This is because index funds follow the trends of the market, allowing you to ride out the highs and the lows. Additionally, many index funds are well diversified and have very low expense ratios literally saving you hundreds of thousands in fees over time.

3) Pay attention to Your Housing Costs

The decision to buy a house is one of the most expensive purchases that many people make within their lifetime. Above all, being prudent in your housing choices and getting a property under 30% of your monthly gross income can be one of the smartest choices for the long run.

4) Cut The Cord

If you are still paying for cable. STOP. There are many ways to get the shows you love at a steeply discounted rate.

- Netflix ($8.99)

- Hulu Without Commericials ($13.08)

- Philo ($20 a month)

- Sling TV ($25 a month)

- Hulu With Live TV ($45 a month)

- YouTube TV ($50 a month)

- PlayStation Vue ($50 a month)

- Fubo TV ($55 a month)

5) Find a Side Hustle

One of the best things about a side hustle is that you can make money in nearly any field. For example, you can drive for Lyft, drive for Grub Hub, deliver packages for Amazon.

Likewise, one can even become a freelancer, tutor kids online or open an Etsy shop. There are a wide plethora of ways to make some cold hard cash in our new gig economy because the possibilities for side hustles are truly endless.

Bonus: Get 40 free listings on Etsy and get started with your side hustles today!

What The FIRE Movement Boils Down To

The main principle of FIRE Movement is to curb excess and focus on what really matters to get you to your ultimate goal: Financial Freedom.

When you have more money in the bank, you have more options in your life. That is a simple fact. Money isn’t everything but it can make life easier.

Reaching FIRE and becoming financially free means having enough money in the bank so that work becomes ‘optional’.

Getting to your FIRE number allows you to do more than sip margaritas on the beach. You can choose to “retire” and instead spend time on projects and adventures that ignites you (pun intended).

What options and choices do you want for your life?

All in all, the FIRE movement is just that…a lifestyle choice.

It requires diligence, time and the most important of all – a plan.

Liked the article? Pin it Down Below