What Is The Debt Avalanche Method?

One of the most popular new year resolutions and biggest financial goals for most people is to become debt free. However, tackling debt can feel overwhelming.

If you’re unsure as to how to chip away at what seems like a huge mountain of debt, you’re not alone.

If we are just talking numbers, then the debt avalanche method is the most cost-effective method to financial freedom.

Pro Tip: Grab Our Free Weekly Progress Guide To Keep Track Of Your Progress

How To Use The Debt Avalanche Method

To begin, you want to gather all your debts (personal, car, etc.) and list them in order from highest to lowest interest.

Using the debt avalanche method, you pay as much as possible towards your highest interest debts.

If you are unsure as to how much extra payments you can or should make, consult your budget. Keep in mind that you still must continue making the minimum payments on all your other loans.

Once your highest payment debt is paid off, you will roll over those payments to your next highest interest loan.

The idea is to attack your high balances first and roll over your cash until you are debt free.

Debt Avalanche Method In Action

Say you have a dentist bill of $800 at 5.7% interest. A car note of $13,200 at 3.9% interest and a credit card balance of $3,000 at 22.8% interest. Using the debt avalanche method, this will be the order of attack.

- Credit Card Balance – 22.8% Interest

- Dentist Bill – 5.7% Interest

- Car Note – 3.9% Interest

The credit card balance carries a top priority because it has the highest interest. You’d put any extra money towards the credit card balance. This strategy will save the most money in the long run

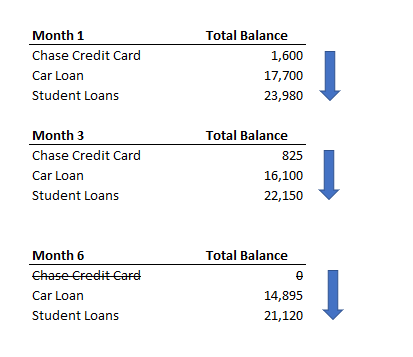

Example:

Advantages Of This Debt Payoff Method

The debt avalanche method helps you by cutting down the interest you will pay overall.

If you have high loan balances, then the debt avalanche method is the most cost-effective way to go. It saves you time and interest since you will be paying off the highest balances first.

Is The Debt Avalanche Method Best For Me?

Those who like the most cost-effective approach, might find that the debt avalanche method works best for them.

Others might instead choose to opt in to the debt-snowball method.

With any debt pay off plan the key measure of success is you.

Make sure to choose a plan that you feel confident you will be able to stick to and switch when you need to.