What Are Target Date Funds?

Target Date Funds, abbreviated as TDFs, are a type of investment fund that allows you to “set it and forget it”. Target Date Funds contain a mix of many different types of bonds, stocks, and other assets.

The best thing about Target Date Funds is that they automatically adjust as time goes by. For example, when you are young, the fund will lean more heavily to assets such as stocks and index funds. It will then start to add in more stable assets like bonds as you age.

Target-date funds help you by taking the guesswork out of saving for your retirement. They are a wonderful investment strategies for most people.

They are an especially wonderful strategy for those who may have some fear about getting into the stock market and choosing their own investment mix.

Advantages And Disadvantages Of A Target Date Fund

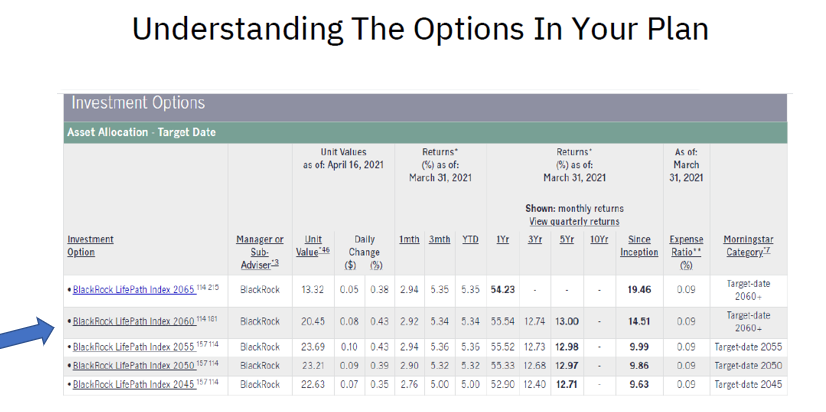

If you have access to a retirement account at work, you more than likely also have access to a Target Date fund. Check in the packet that HR gave you and look through the investment options. The types of investments are usually broken down into these categories: Target Date Funds, Growth and Bonds/Fixed Income.

There will usually be more than one Target Date fund option listed; all with the same expense ratio. You will want to choose the one with the date that is closest to when you plan to retire.

Planning for retirement can seem daunting, but it really does not have to be. With a Target Date fund, you get a very diversified mix of equities and fixed income (bonds) that automatically rebalances with time.

It’s no wonder that the use of TDFs has increased throughout the years.

The Benefits Of Target date funds (tdfs)

A few advantages of TDFs are as followed:

- Set It And Forget About It

This is the biggest benefit of these funds. People who don’t invest in the TDFs, have to rebalance their portfolios ever so often. They do this so that their asset allocation doesn’t go too far away from their target percentages.

With a TDF, you don’t have to schedule time aside to rebalance your investments because the fund does that for you. In such a way, these funds are very hands-free. You only have to determine how much money you want to stock away each month.

- TDFs Are Diversified

TDFs are, by design, very diversified. These funds mostly have a mix of stocks to bonds that will change as you age.

In addition to this, they have both domestic and international exposure. For instance most TDFs have 20-30% of the assets invested internationally.

This makes the TDF a very appealing choice.

That Sounds Great, But What Are Some Cons Of A Target Date Fund?

Life would be wonderful if there was all upside to every decision. Atlas, that is hardly ever the case.

Here are a few cons of choosing a Target Date Fund:

- Risk Tolerance Varies

The risk tolerance of one person versus another may be very different. Target Date funds don’t see the same type of gains as one would get if they had an all stock portfolio.

For example, someone who is invested 100% in a tech company that ends up being Amazon 2.0 will see much greater returns on their investments than someone invested in a TDF.

In other words, if you wish to take on more risk for the potential of more reward, the TDF may not be the best choice for you.

- High International Exposure

This one is kind of subjective. A lot of people living in the US don’t see the need to have exposure to international funds. I can understand the argument because most big name companies are already operating globally. Many of the TDFs have a relatively high international exposure.

If you are okay with having 20-30% of your overall portfolio in international funds, then it is perfectly fine.

I do want to make one caveat though. If you want a slightly smaller international exposure, that does not mean you have to give up on Target Date funds completely.

For example, you can add in more US stocks to your portfolio by buying the S&P 500 index fund. This will in turn reduce your overall international exposure down to a percentage that you like while also allowing you to still invest in TDFs.

What Type Of Investor May Like A Target Date Fund?

Target Date funds are great for people who might not have the desire to learn the ins and outs of stock picking/day trading or take the time to research a company. It is also a great investment option for those who may want to have a hands-off approach to their retirement.

They are even a smart move for those who tend to always tinker with the fund’s allocation in their 401K.

Personal finances is just that, personal.

You have to decide which option is best for you, your personality and your goals.

Are you invested in a Target Date fund? If so, what is your goal retirement year? Mine is 2035.