Contradictory to what some people may think, retirement is not an age, it is a financial number.

There isn’t any law that says that you have to work until you are 65.

Many people all over the world are joining in on the FIRE movement in order to expedite their timeline to retirement.

The path to financial independence relies on a combination of two “levers”. First, one can work on increasing their income be it through a W2 job, side hustles, etc.

The other lever is to work on decreasing your overall outgoing expenses. This variance, often referred to as “the gap” by Paula Pant, is where the magic occurs.

Once you build up the gap, you can then use that money in ways that helps generate even more income. For example, you can use money from the gap to start a business, invest in real estate or dollar cost average into the stock market.

What Is FIRE Movement Actually About?

The OGs of FIRE are popular names like Mr. Money Mustache and MadFIentist. Early adopters of “FIRE” tended to be mostly white male software engineers. However, nowadays, there are plenty of diverse voices within the FIRE movement to learn from and be inspired by.

FIRE is an abbreviation which stands for Financial Independence, Retire Early. The goal is to save your money and invest aggressively. Most people within the movement are regularly stocking away somewhere in between 50 to 75% of their income.

But how do people do this?

People focused on FIRE are typically balancing two main things: keeping their expenses low and raising their income.

The general idea is that the more income you make, the more income you can save. Investing this difference is what helps most people quickly reach financial independence.

For people that are in the FIRE movement, being financially independent doesn’t only mean sitting on tropical beaches or binge watching Netflix. It means getting back freedom and the most precious resource: time.

Once you reach your financial independence number, you don’t need to work a full-time job if you don’t wish to. Some people even choose to scale back to a part-time job or “fun-employment”.

The choice is yours.

The Various Types Of “FIRE” Explained

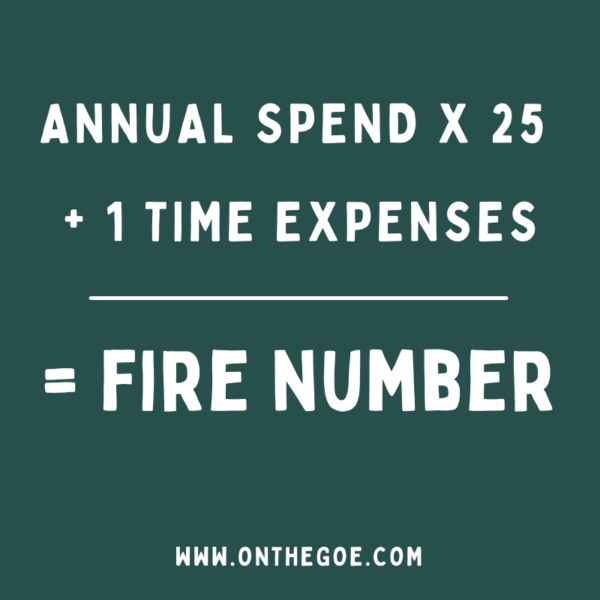

To calculate your FIRE number, you must first look at your yearly expenses. How much money do you tend to spend? Are you someone who can live comfortably on $40K a year after taxes? Or, are you someone who would rather have $80K to spend each year?

Once you have your target yearly expenses down multiple that number by 25. If you want to be more conservative you can multiply that number by 30. That is personally what I do.

Additionally, you may want to add in those big one time purchases and expenses. And, there you have it, your FIRE number!

FIRE is not a one size fits all model. For one thing, each person has to determine what their FIRE target is. There are several types of path one can take within the movement. It just depends on what your goal is and what type of lifestyle you want to have.

Lean FIRE:

Lean FIRE is essentially lowering your overall expenses so that your FIRE number is not as high. The actual FIRE number range may vary depending on who you talk to.

However, on average, Lean FIRE means a FIRE number anywhere between 750k up to a Million.

If you are thinking of it in terms of a spectrum, Lean FIRE will come before FIRE and Fat FIRE.

Regular FIRE

The most common number you will find referenced on FIRE blogs is 1 million dollars. To a lot of people, myself included, that is a crap ton on money! A lot of people pursuing regular FIRE are aiming to reach at least 1 million in assets.

They calculated their fire number by assuming a $40K a year annual spend. $40k X 25 = 1 Million.

The range for FIRE is usually expenses between $40K – $100K a year.

FAT FIRE

Fat FIRE is the pursuit of Financial Independence on steroids. In other words, it is when you aim to enter into your retirement with FAT pockets. A lot of people could say, it is the most ideal early retirement lifestyle.

A Fat FIRE portfolio means that you will be able to live it up in retirement without having to sacrifice your spending. It could even mean increasing spending for a lot of people.

If you are on the path to Fat FIRE, you may be calculating your FIRE number as anywhere north of $2.5 Million.

Barista FIRE (SOmetimes Called Coast FIre):

To me, this seems like the worst type of FIRE. But to each their own.

Barista FIRE is essentially saving and investing enough money so that you only need a part time job or the occasional gig to fund your life. It is, in my opinion, semi-retirement.

You still need funds, just not as much.

I guess a potential benefit of Barista FIRE is that you have more flexibility to choose what types of work you will take on. Since one does not typically need a ‘well paying’ job to make ends meet, there are more options available.

This could be a good option for people who actually like working but would rather take on consulting work instead of being in the office 5 days a week.

The typical Barista FIRE person or a couple may have these attributes:

- Lives in the middle to lower-cost city

- Has a working spouse

- Works part time

Why Is FIRE & Financial Independence A Good Option?

Reaching financial independence can save you from financial hurdles and hassles. Most importantly, it affords you the freedom of choice.

With enough money in the bank you can choose to spend your time learning new skills. You can also choose to volunteer your time to causes that matter most to you.

Even if early retirement is not for you, pursuing financial independence is something I would encourage for everyone.

Having a financial safety net allows you to spend more time with loved ones. Most importantly, it allows you to keep a roof over your head and food on your table in the case of a job or health setback.