… I finally crossed off one of my biggest milestones to date! I officially hit $100K invested in August 2021.

My official trek into the corporate world began in early 2017, but I have been working since my freshman year of high school. Growing up, I did not know about investing nor had many examples of responsible financial decision-making.

During my first job in Corporate America, I did not invest a single dime. It actually was not until Spring 2018 that I made my first contribution to a 401K.

At that time I had a $65K salary and was contributing 10% pre-tax to various funds within my 401K. By the time I left that company, I had a little over $4K in my 401K account and I was thrilled.

At my next company, there was no 401K. The early retirement bug had bite me so I knew I had to stock away some of this money for ‘future me’. For the first year at Company X, I chose to contribute $500 a paycheck to a taxable brokerage account and I also placed $5.5K into my ROTH IRA that year. The next year Company X stated we were getting a 401K.

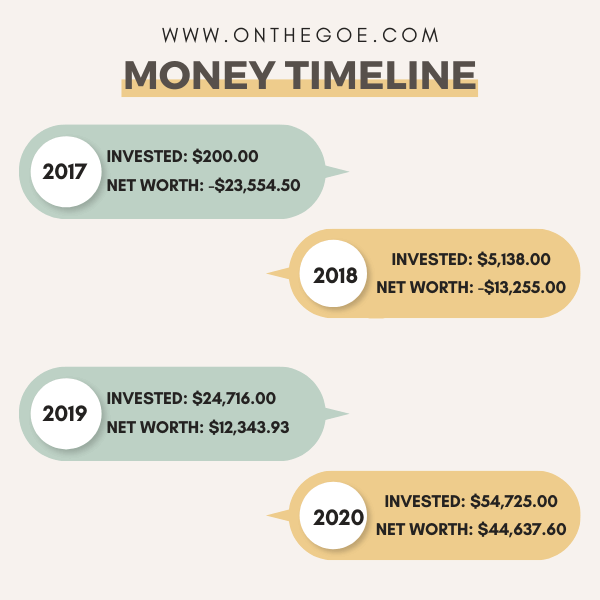

I wish I had kept better track of how much money I ended up putting in my 401K at Company X. However, I was able to piece together where I was financially at the end of each year. Check out my progress below.

My Timeline to 100K

2017 – fOMO YOLO

Indeed, I was absolutely reckless with my money in 2017. I worked very hard in grad school (5+ jobs and 15 credit semesters) in order to GTFO of there in less than 2 years. Fast forward 2 months after graduation, I finally landed my first corporate gig in February 2017.

Landing this job, at first, seemed like a dream. This was the first time my paycheck would actually have a comma in it. What did I do with all my money? Spent it on trips and eating out.

$4,346.53 on travel and honestly probably somewhere between $3-5K on eating out and going out.

Luckily for me, my perspective on money started to shift. At the end of 2017 I started listening to finance podcasts regularly. It was a game changer for me and really made me examine my finances.

Thanks to the financial wisdom I was hearing and fear of FOMO, I opened a ROTH IRA at the end of the year and contributed $200 to it.

2018 – It’s Finally Catching On

I finally started contributing to my workplace 401K in the spring on 2018. At the time, I set my contribution limits to 10% each paycheck. I also added an additional $800 to my Roth IRA so that I would have $1K invested. However, I still did not really understand how to navigate my accounts so my money just sat there in a money market account.

During 2018 I was mostly focused on paying down my debt because that was also the year I got a brand new car (before I found out about FIRE).

2019 – Let’s Fucking Get It

I started a new job with a slightly better income but significantly worse people. At this time, I was pretty much DEEP into the Financial Independence Retire Early Movement. I knew what to do with my investments and was crafting my rich life with intention.

I ended the year with nearly $25K invested and a positive net worth for the first time.

2020 – Debt Who?

Going into 2020 was when I got “serious” about my debt pay off journey. I had lofty goals for the year (hindsight is 2020) and dreams galore. Although 2020 was….less than ideal, I had a lot of financial gains.

I started selling things on Amazon Merch and also opened up a second Etsy store.

By the end of 2020, I was able to finish paying off my student loans. At the end of the year I also had over $50K invested. This means I had over 273x more money invested at the end of 2020 then I did a few years prior. Yay me.

2021 – 6 figures baby

Technically, the year is still going. But as of this article, both my investments and my net worth are slightly over 6 figures.

Thoughts On My Progress

I spent most of 2020 and 2021 surrounded in the personal finance bubble. Hence, I had both motivation and quite honestly…angst.

I enjoyed tracking my financial progress and all the friendships I made.

What I did not enjoy was the constant comparison I felt. Of course, this was all self driven but it was unpleasant nonetheless.

I felt myself constantly comparing my progress, my salary, my side hustle income – essentially everything around money – with others.

I would be genuinely happy with making $200 on a side hustle and then start second guessing myself when I saw someone else made $200 + X. It would not matter if we were in totally different niches, I just wanted what others had. That was obviously an unhealthy way to go about things, so I left IG and YouTube.

Nowadays, I am keeping myself motivated through my spreadsheet and my blog. For 2022, I am going to be heavily relying on the power of compound interest. I already know next year will be the most expensive year of my adult life.

There are a lot of things I have pre-committed to pay for. There are also a lot of things I want to do for myself. I am curious to see where I will end the year. All in all, I am proud of all the progress I have made to earn my first 100K.